Diamond jewelry offers more than sparkle. It brings together style, confidence, and timeless charm. Whether it is a subtle stud or a bold statement piece, diamonds have the power to elevate any look. The perfect diamond jewelry strikes a fine balance it should shine without overpowering, and it should reflect your personal style while remaining versatile. When chosen thoughtfully, diamond pieces become part of your identity, making every moment feel special and sophisticated.

Why Shine and Style Matter Together

Wearing diamonds is not only about luxury it is about expression. A balanced diamond piece blends brightness and personal taste, so it complements different outfits and occasions. The best pieces do not just sparkle they belong to you. When diamonds match your lifestyle and personality, they become more than accessories.

What Makes Diamond Jewelry Shine

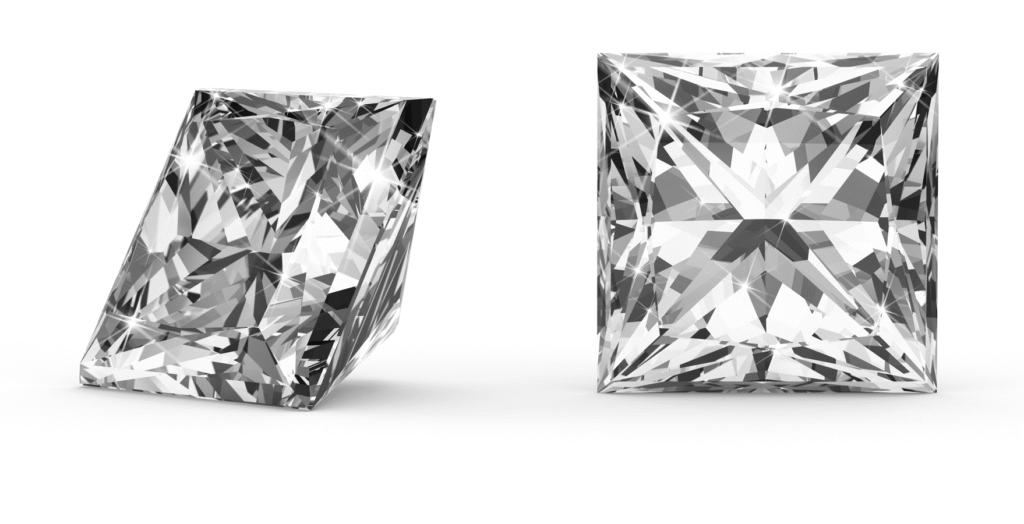

Not all sparkle is equal. The shine of a diamond depends on key features that affect its brilliance and beauty.

Key factors that affect diamond shine:

- Cut: A well-cut diamond reflects more light, creating a strong sparkle.

- Clarity: Fewer flaws mean more light passes through, adding brilliance.

- Color: Clearer diamonds closer to colorless tend to shine brighter.

- Setting: How the diamond is placed enhances how much light it catches.

Choosing crown jewels biggest diamond pieces with these features in mind helps ensure your jewelry catches the eye for the right reasons.

Balancing Shine with Style

Shine alone is not enough. To truly stand out, diamond jewelry should reflect your personal style.

Here’s how to find the right match:

- Minimalist Looks: Choose sleek studs or solitaire pendants. These offer shine without too much boldness.

- Bold Style: Opt for layered diamond necklaces or cocktail rings. These make a strong visual statement.

- Daily Wear: Go for small, durable designs like tennis bracelets or bezel-set earrings.

- Evening Glamour: Pick dramatic drop earrings or large cluster rings to turn heads.

Matching the shine level with the occasion and your style helps you wear diamonds confidently and comfortably.

Smart Styling Tips

To bring out the best in your diamond pieces, a few styling tips can help:

- Mix textures: Combine smooth metals with faceted diamonds for contrast.

- Layer thoughtfully: Wear multiple pieces, but balance bold with simple.

- Stick to a color theme: Keep the metal tone consistent for a polished look.

- Focus on one feature piece: Let one item shine while others support.

These simple choices make your jewelry feel intentional rather than overwhelming.

Choosing Jewelry That Lasts

Great style is timeless. When selecting diamond jewelry, think about how it fits into your long-term wardrobe.

Look for:

- Versatile designs that work with casual and formal outfits

- Quality craftsmanship that ensures durability

- Classic styles that do not follow short-term trends

Investing in a few well-made, well-chosen pieces ensures you always have something to wear, no matter the occasion.

Conclusion

Diamond jewelry that balances shine and style becomes more than decoration it becomes part of your identity. By focusing on brilliance, comfort, and personal taste, you can build a collection that adds elegance to everyday life and glamour to special events. Choose pieces that speak to you, and let your diamonds tell your story with every sparkle. Glow with handpicked diamond treasures.

Visit soon:

9040 Roswell Rd, Suite 530 Sandy Springs, GA 30350